Kamakura Troubled Company Index Decreases by 0.54% to 7.61%

Credit Quality Improves to the 99th Percentile

NEW YORK, September 1, 2022: Kamakura Corporation reported today that its Expected Cumulative Default Rate for all rated firms world-wide dropped to 8.41% on August 31, more than 3 full percentage points below the 11.44% level reported at the peak of the Great Financial Crisis in 2008. Despite recent volatility in stock prices and U.S. Treasury yields, the longer-term outlook for expected defaults has returned to moderate levels after the initial shocks of the “covid economy” in 2020 and 2021.

Beginning in July, the Kamakura Troubled Company Index® is reported using the new Version 7.0 default probability models from Kamakura Risk Information Services. The index for August 31 shows that short-term default risk also improved over the month. Credit conditions moved up 2 percentage points to the 99th percentile of the period from 1990 to the present. The 100th percentile indicates the best credit conditions during that period. The Kamakura Troubled Company Index closed in August at 7.61%, compared to 8.15% the month before. The index measures the percentage of 41,500 public firms worldwide with an annualized one-month default probability over 1%. An increase in the index reflects declining credit quality, while a decrease reflects improving credit quality.

At the end of August, the percentage of companies with a default probability between 1% and 5% was 5.84%. The percentage with a default probability between 5% and 10% was 0.92%. Those with a default probability between 10% and 20% amounted to 0.57% of the total; those with a default probability of over 20% amounted to 0.28%. Short-term default probabilities ranged from a low of 7.20% on August 18 to a high of 8.34% on August 2.

Figure 1: Troubled Company Index — August 31, 2022

At the end of August, 16 of the riskiest rated public firms worldwide were in the United States, with one each in Germany, Italy, the United Kingdom and Luxembourg. The riskiest rated firm was Loyalty Ventures Inc. (LYLT), with a one-year KDP of 48.05%, up 24.80% from the previous month. Despite the good overall credit quality globally, there were five defaults in the KRIS coverage universe in August: Endo International PLC (Ireland: ENDPQ), Avaya Holdings Corporation (USA: AVYA), Unifin Financiera (Mexico: UNIFINA), China Creative Global Holdings (Hong Kong: 1678), and China Shipping Haisheng Co. (China: 600896).

Table 1: Riskiest Rated Companies Based on 1-Year KDP – August 31, 2022

The Kamakura Expected Cumulative Default Rate, the only daily index of credit quality of rated firms worldwide, shows the one-year rate down 0.17% at 0.65%, and the 10-year rate down 1.10% at 8.41%. Note that the 10-year expected cumulative default rate in November, 2008, the height of the Great Financial Crisis, was 11.44%. Effective beginning in July 2022, the Expected Cumulative Default Rate is also reported using the KRIS Version 7.0 default models.

Figure 2: Expected Cumulative Default Rate — August 31, 2022

Commentary

Donald R. van Deventer,

Managing Director at Kamakura Corporation a SAS Institute Inc. Company

The release of the new KRIS version 7.0 credit models this summer was a carefully chosen point in time. The impacts of the dramatic covid shocks could be carefully measured, and many astute economic forecasters expect 2022 to be the turning point in this iteration of the credit cycle. Figure 2 shows that the covid shocks came in two waves that were both dramatic and short-lived. Capturing these impacts quickly was a priority for both the KRIS team at SAS Institute Inc. and for KRIS clients.

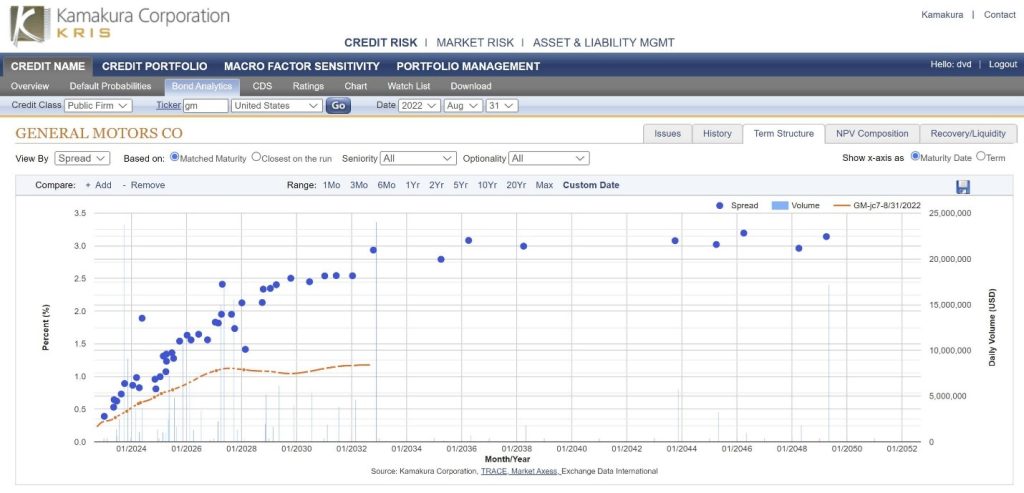

The KRIS team monitors credit model performance on a daily basis, with results displayed visually on www.kris-online.com. The ultimate out-of-sample cross validation of a credit model is the accuracy of the model’s mark-to-market bond price calculations. Figure 3 compares the term structure of traditional credit spreads with the term structure of version 7.0 KRIS default probabilities for General Motors (GM) on August 31. The difference between the two curves is explained by the market’s expectation for recovery in the event of default and by the market liquidity premium observed in the corporate bond market. For more details on the calculation, see Hilscher, Jarrow and van Deventer (January 2022).

Figure 3: Cross Validation for General Motors — August 31, 2022

The credit-risk-adjusted returns in the bond market are a major focus of KRIS institutional clients. A daily analysis of credit-risk-adjusted returns is also available to individual investors via the Corporate Bond Investor.

Power users of the KRIS service can simulate the future probability distribution of credit losses in their portfolio using KRIS Credit Portfolio Manager. KRIS Credit Portfolio Manager is a seamless software-as-a-service that employs the powerful analytics of Kamakura Risk Manager and KRIS default probabilities. For more information about this capability of KRM via KRIS, please contact the KRIS team of SAS Institute Inc. at info@kamakuraco.com.

About the Troubled Company Index

The Kamakura Troubled Company Index® measures the percentage of 41,500 public firms in 76 countries that have an annualized one-month default risk of over one percent. The average index value since January 1990 is 14.43%. Since July 2022, the Kamakura index has used the annualized one-month default probability produced by the KRIS version 7.0 Jarrow-Chava reduced form default probability model, a formula that bases default predictions on a sophisticated combination of financial ratios, stock price history, and macro-economic factors.

The KRIS version 7.0 models were developed using a data base of more than 4 million observations and more than 4,000 corporate failures. A complete technical guide, including full model test results and key parameters, is provided to subscribers. The KRIS service also includes a wide array of other default probability models that can be seamlessly loaded into Kamakura’s state-of-the-art enterprise risk management software engine Kamakura Risk Manager. Available models include the non-public-firm default model, the U.S. bank model, and the sovereign model. Related data includes market-implied credit spreads, and prices on all traded corporate bonds traded in the U.S. market. Macro factor parameter subscriptions include Heath, Jarrow, and Morton term structure models for government securities yields in Australia, Canada, France, Germany, Italy, Japan, Russia, Singapore, Spain, Sweden, Thailand, the United Kingdom, and the United States, plus a 13-country “World” model. All parameters are derived in a no-arbitrage manner consistent with seminal papers by Heath, Jarrow, and Morton, as well as Amin and Jarrow. A KRIS Macro Factor Scenario Service subscription includes both risk neutral and “real world” empirical scenarios for interest rates and macro factors.

The version 7.0 model was estimated over the period from 1990 through the Great Financial Crisis and ending in February 2022. The 76 countries currently covered by the index are Argentina, Australia, Austria, Bahrain, Bangladesh, Belgium, Belize, Botswana, Brazil, Bulgaria, Canada, Chile, China, Colombia, Croatia, Cyprus, Czech Republic, Denmark, Egypt, Estonia, Finland, France, Germany, Ghana, Greece, Hungary, Hong Kong, Iceland, India, Indonesia, Ireland, Israel, Italy, Japan, Jordan, Kenya, Kuwait, Luxembourg, Malaysia, Malta, Mauritius, Mexico, Nigeria, the Netherlands, New Zealand, Norway, Oman, Pakistan, Peru, the Philippines, Poland, Portugal, Qatar, Romania, Russia, Saudi Arabia, Serbia, Singapore, Slovakia, Slovenia, South Africa, South Korea, Spain, Sri Lanka, Sweden, Switzerland, Tanzania, Taiwan, Thailand, Turkey, the United Arab Emirates, Uganda, the UK, the U.S., Vietnam and Zimbabwe.

About SAS

SAS is the leader in analytics. Through innovative software and services, SAS empowers and inspires customers around the world to transform data into intelligence. SAS gives you THE POWER TO KNOW®.

Editorial contacts:

- Martin Zorn – Martin.Zorn@sas.com

- Stas Melnikov – Stas.Melnikov@sas.com