Kamakura Troubled Company Index Decreases by 0.90% to 4.40%

Credit Quality Remains Strong and rises to the 99th Percentile

NEW YORK, January 3, 2022: Despite the emergence of the Omicron Covid strain, uncertainty around U.S. fiscal policies and EU monetary actions, and increased inflation expectations, the markets continued to perform remarkably well in December. Defaults remain extremely low. Interest rates also remain low, with high liquidity and growth exceeding expectations.

The role of risk management is not to predict the future, but to analyze, simulate and evaluate conditions that could happen and develop appropriate game plans. We will end the year by looking ahead to the risks that should be on our radar for the new year.

The Kamakura Troubled Company Index® indicates that credit quality remained low by historical measures and decreased in December to 4.40% compared to 5.30% last month. Volatility increased with default probabilities ranging from 3.18% on December 3 to 5.77% on December 3. Over the past year, the index has declined by 10.66%. The low was set on August 12, at 2.06%. An increase in the index reflects declining credit quality, while a decrease reflects improving credit quality.

At the close of December, the percentage of companies with a default probability between 1% and 5% was 3.90%, a decrease of 0.62% from the previous month. The percentage with a default probability between 5% and 10% was 0.41%, a decrease of 0.24%. Those with a default probability between 10% and 20% amounted to 0.08% of the total, representing a decrease of 0.03%; and those with a default probability of over 20% amounted to 0.01%, a decrease of 0.01% over the prior month. This level shows that worldwide corporate credit quality is at the 99th percentile for the period of 1990 to 2021, with 100 indicating “best conditions.”

Figure 1: Troubled Company Index — December 31, 2021

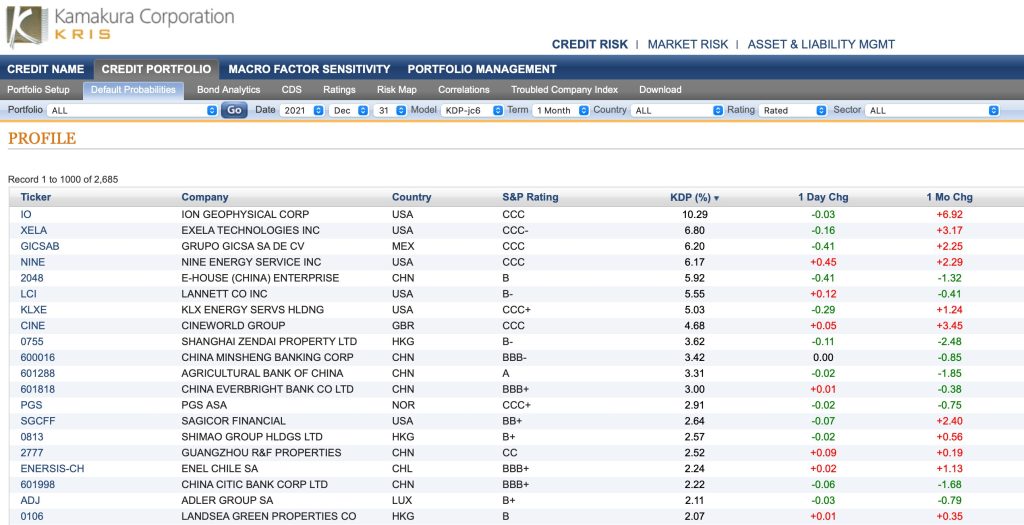

Among the 20 riskiest-rated firms listed in December nine were in China, with six in the U.S. and one each in Chile, Great Britain, Luxembourg, Mexico, and Norway. The riskiest-rated firm was ION Geophysical Corp (NYSE:ION), with a one-month KDP of 10.29%, up 6.92% from the previous month. Codere S.A. (BME:CDR), had its Local Currency LT credit rating withdrawn on December 17. There were two global defaults in the Kamakura coverage universe, one each in China and Malaysia.

Table 1: Riskiest-Rated Companies Based on 1-Month KDP – December 31, 2021

The number of global defaults in our coverage universe during 2021 was 61, down significantly from 222 in 2020. This trend also held true for the U.S. alone, which experienced 20 defaults in 2021, compared to 89 in 2020 (Figure 2).

Figure 2: Default Rate — December 31, 2021 v 2020

The Kamakura Expected Cumulative Default Rate, the only daily index of credit quality for rated firms worldwide, shows the one-year rate down 0.17% at 1. 23%, and the 10-year rate up 0.01% at 19.16%.

Figure 3: Expected Cumulative Default Rate — December 31, 2021

Commentary

By Martin Zorn, President and Chief Operating Officer, Kamakura Corporation

When we entered December with the new threat of the Omicron variant, the markets initially sold off, but then quickly recovered and continued their march upward. It was just another example of a year that proved to be financially resilient, no matter what uncertainties unfolded. One must wonder if the markets in 2022 will continue to overcome whatever gets thrown at them, or whether they will slow to adjust to an environment containing an increasing number of uncertainties. Another possibility is a correction. If we do have one, will it be mild, or will the markets overreact to the downside?

There has been much debate about inflation. For many months central bankers insisted it was transitory. But the narrative began to shift as excess savings that were accumulated during the pandemic led to pent-up demand – amid significantly insufficient supply and bottlenecks. Policy makers then said they hoped this situation will correct itself. (Hope is not a strategy, but that’s a discussion for another time.) Central banks have long insisted they have the tools to fight inflation, but do they have the backbone to use them? Have they already waited too long, and will these above-target inflation rates be with us longer than expected? These questions imply that we should model rate hikes both slower and faster than expected, as well as using lower and higher figures than the markets seem to indicate.

In addition, geopolitical risks are rising. Russia and Ukraine, China and Taiwan, a nuclear Iran and expanding and shifting alliances in the Middle East are a few examples of the risks we see in current headlines. While Afghanistan seems to have evaporated from the headlines, the risks there remain, as do the continual risks of escalating conflict between India and Pakistan. Global risk is always a “known unknown,” which for forecasting purposes means deterministic modeling is not enough, and one should include stochastic models in the tool kit.

Another perennial headline grabber is environmental risks, which are primarily being addressed through regulatory means rather than allowing market solutions to evolve. I am at an age to remember Ronald Reagan’s famous statement: “The nine most terrifying words in the English language are ‘I’m from the government, and I’m here to help.’”

Central planning simply does not work. Regulatory reforms often lead to unanticipated consequences, and environmental risks are no exception. When government policies pick winners and losers, what could possibly go wrong? We will undoubtedly find out.

During 2021 we also saw the rise of “meme stocks,” crypto assets and the use of SPACs as an easy way to go public without providing the transparency of a normal offering. Having been involved in filing many Form S-1s and Form S-3s, I appreciate the fact that launching a SPAC is easier. But I am also aware that the lack of transparency carries its own set of risks.

I cannot conclude a list of potential risks without asking about what is next for Covid. The virus has been the primary disruptor of business, the economy, and modeling and risk management for two years. While we can’t yet model this known unknown, it is a factor that risk managers will need to consider in 2022, and possibly beyond.

As we conclude 2021, we want to remind our readers that the role of risk management is to anticipate what may happen and be prepared to respond quickly to a dynamic environment. Of all the risks we’ve mentioned, inflation and interest rates are the most immediate concerns, and both are directly impacted by the effects of policies and mismanagement.

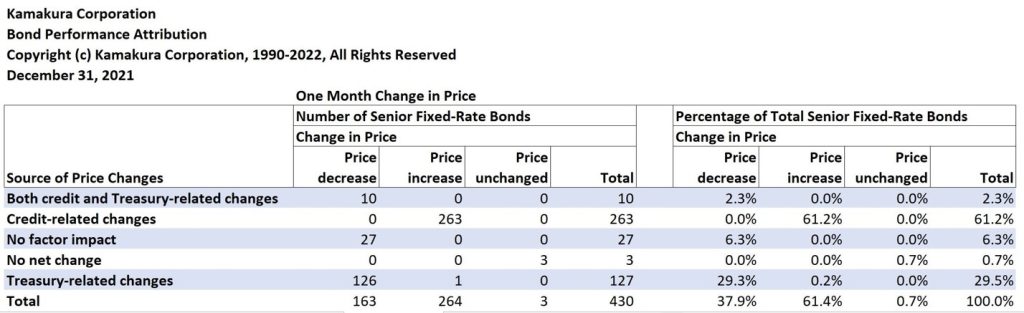

The best indicator of inflation is the medium-term Treasury markets. The best indicator of default risk is the bond markets. I closely follow our CEO Dr. Donald van Deventer’s daily blog Corporate Bond Investor in this regard to examine the daily attribution of risks as they relate to changes in bond prices. Table 2 below shows the one-month attribution as of December 31, 2021.

Table 2: Bond Performance Attribution – December 31, 2021

Dr. van Deventer’s analysis provides insights into whether price changes are driven by systemic risks (as measured by Treasury-related changes) or company-specific risks (as measured by credit-related changes). The bond market has a strong track record for providing insights about future economic growth.

We want to wish our readers the very best for the new year!

About the Troubled Company Index

The Kamakura Troubled Company Index® measures the percentage of 40,500 public firms in 76 countries that have an annualized one- month default risk of over one percent. The average index value since January 1990 is 14.32%. Since November 2015, the Kamakura index has used the annualized one-month default probability produced by the KRIS version 6.0 Jarrow-Chava reduced form default probability model, a formula that bases default predictions on a sophisticated combination of financial ratios, stock price history, and macro-economic factors.

The KRIS version 6.0 models were developed using a data base of more than 2.2 million observations and more than 2,600 corporate failures. A complete technical guide, including full model test results and parameters, is provided to subscribers. The KRIS service also includes a wide array of other default probability models that can be seamlessly loaded into Kamakura’s state-of-the-art enterprise risk management software engine, the Kamakura Risk Manager. Available models include the non-public-firm default model, the commercial real estate model, the U.S. bank model, and the sovereign model. Related data includes credit default swap trading volume by reference name, market implied credit spreads, and prices on all traded corporate bonds traded in the U.S. market. Macro factor parameter subscriptions include Heath, Jarrow, and Morton term structure models for government securities in the U.S., Germany, the UK, Canada, Spain, Sweden, Australia, Japan, Thailand, and Singapore. All parameters are derived in a no-arbitrage manner consistent with seminal papers by Heath, Jarrow, and Morton, as well as Amin and Jarrow. A KRIS Macro Factor Scenario Service subscription includes both risk neutral and “real world” empirical scenarios for interest rates and macro factors.

The version 6.0 model was estimated over the period from 1990 to May 2014 and includes the insights of the entirety of the recent credit crisis. The 76 countries currently covered by the index are: Argentina, Australia, Austria, Bahrain, Bangladesh, Belgium, Belize, Botswana, Brazil, Bulgaria, Canada, Chile, China, Colombia, Croatia, Cyprus, Czech Republic, Denmark, Egypt, Estonia, Finland, France, Germany, Ghana, Greece, Hungary, Hong Kong, Iceland, India, Indonesia, Ireland, Israel, Italy, Japan, Jordan, Kenya, Kuwait, Luxembourg, Malaysia, Malta, Mauritius, Mexico, Nigeria, the Netherlands, New Zealand, Norway, Oman, Pakistan, Peru, the Philippines, Poland, Portugal, Qatar, Romania, Russia, Saudi Arabia, Serbia, Singapore, Slovakia, Slovenia, South Africa, South Korea, Spain, Sri Lanka, Sweden, Switzerland, Tanzania, Taiwan, Thailand, Turkey, the United Arab Emirates, Uganda, the UK, the U.S., Vietnam and Zimbabwe.

About Kamakura Corporation

Founded in 1990, Honolulu-based Kamakura Corporation is a leading provider of risk management information, processing, and software. Kamakura was recognized as a category leader in the Chartis Report, Technology Solutions for Credit Risk 2.0 2018. Kamakura was named to the World Finance 100 by the editor and readers of World Finance magazine in 2017, 2016 and 2012. In 2010, Kamakura was the only vendor to win two Credit Magazine innovation awards., Kamakura Risk Manager, first sold commercially in 1993 and now in version 10.1, is the first enterprise risk management system for users focused on credit risk, asset and liability management, market risk, stress testing, liquidity risk, counterparty credit risk, and capital allocation from a single software solution. The KRIS public firm default service was launched in 2002. The KRIS sovereign default service, the world’s first, was launched in 2008, and the KRIS non-public firm default service was offered beginning in 2011. Kamakura added its U.S. Bank default probability service in 2014.

Kamakura has served more than 330 clients with assets ranging in size from $1.5 billion to $7.0 trillion. Current clients have a combined “total assets” or “assets under management” in excess of $38 trillion. Its risk management products are currently used in 47 countries, including the United States, Canada, Germany, the Netherlands, France, Austria, Switzerland, the United Kingdom, Russia, Ukraine, South Africa, Australia, China, Hong Kong, India, Indonesia, Japan, Korea, Malaysia, Singapore, Sri Lanka, Taiwan, Thailand, Vietnam, and many other countries in Asia, Europe and the Middle East.

To follow risk commentary by Kamakura on a daily basis, please follow:

Kamakura CEO, Dr. Donald van Deventer (www.twitter.com/dvandeventer)

Kamakura President, Martin Zorn (www.twitter.com/riskmgrhi)

Kamakura’s official twitter account (www.twitter.com/KamakuraCo).

For more information, please contact:

Kamakura Corporation

2222 Kalakaua Avenue, Suite 1400, Honolulu, Hawaii 96815

Telephone: 1-808-791-9888

Facsimile: 1-808-791-9898

Information: info@kamakuraco.com

Web site: www.kamakuraco.com