There is No Free Lunch:

How Portfolio Managers Need to Adapt to a Shifting Macroeconomic Paradigm

Martin Zorn

May 19, 2022

Presentation to the IACPM Spring Conference

Madrid, Spain

Abstract

Over the past 50 years, the markets have witnessed many shocks and changes to the macroeconomic paradigms. From the “Great Inflation” cycle from 1965-1982 to the Latin America Crisis (1982), Junk Bond Crisis (1989), Asia Crisis (1997), Russian Crisis (1998), Dotcom Bubble (1999-2000), Great Recession (2007-2009) to “Transitory Inflation” (2021-?). Most of the participants of the IACPM conference have only experienced one of these cycles as portfolio or risk managers and for many the current environment is their first experience with shifting paradigms and new risks.

In this environment robust models are critical but understanding how your models work are equally critical. The author’s conclusions are that risk managers need to be prepared for the following risks over the next few years.

- Geopolitical flashpoints are not going away

- Well intentioned policies – fiscal and monetary – have high risks for unintended consequences

- The credit cycle has not been repealed – prepare for rising defaults

- Central bank levers to control inflation are weaker and have lower breaking points given private and public leverage than during the Volcker years

A PDF version of this presentation can be found here:

IACPM_2022_SpringConferenceKamakura

Comments and questions are welcome at info@kamakuraco.com

We are seeing shifting paradigms, unanticipated challenges economically as well geo-politically as well as unanticipated consequences of the covid policies that are challenging common wisdom, common assumptions and the common use of the models we use to operate our businesses.

George Box famously said “All Models are wrong, but some are useful”

John Maynard Keynes was to have said “When the facts change, I change my mind, what do you do?”

With those thoughts we will look at what the data shows since the outbreak of Covid and decide whether our models are still useful and what are the facts that we should consider going forward.

Even the smartest people in the room can be wrong. What can we learn from past failures to guide us today?

In 2012 at the Federal Reserve symposium in Jackson Hole, Wyoming, a young central banker, Andy Haldane at the time the head of Financial Stability for the Bank of England said the “emperor has no clothes” referring to the ever increasing complexity of the regulatory models.

A ballplayer can calculate the trajectory of the ball when making a catch.

Or like a border collie he can use the “Gaze heuristic” to make the catch. Sometimes simplicity is advantageous to complexity. A colleague once remarked that anyone can make the simple seem complex but it is a real art to make the complex seem simple.

As we emerge from the Covid pandemic we are witnessing “the great resignation”, “transitory inflation that is not so transitory anymore”, rising interest rates to combat inflation and a rebalancing of foreign exchange relationships.

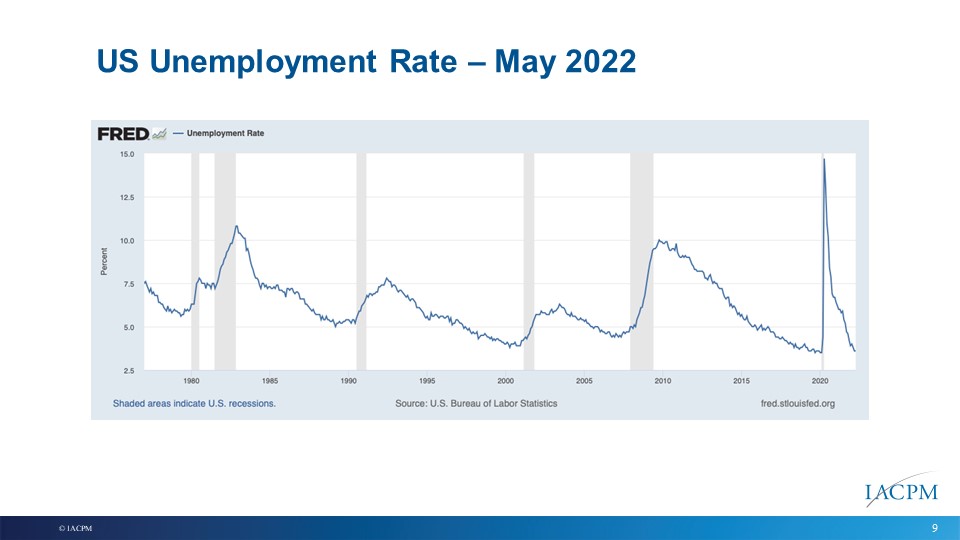

Of particular interest is that that unemployment was a leading indicator in the February 2020 recession while it was a trailing factor in prior recessions.

While unemployment has dropped in many countries the decline in the US has been more dramatic than across the EU.

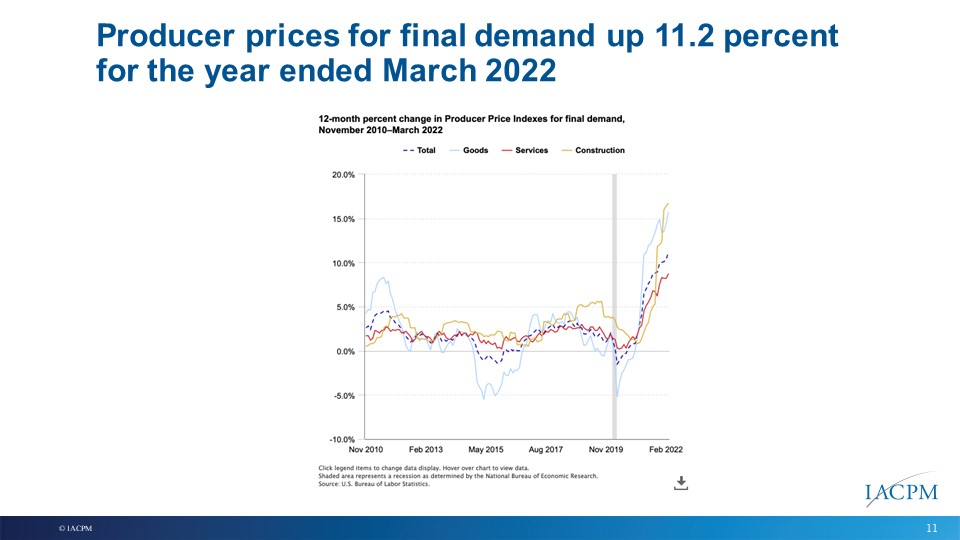

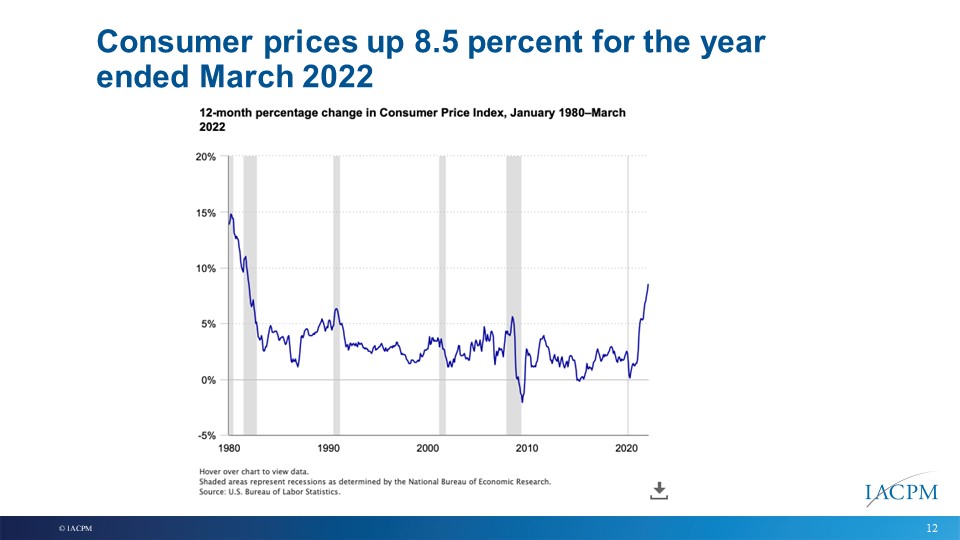

Both producer and consumer price changes speak for themselves with respect to the inflationary pressure that exists.

Milton Friedman said that all inflation was a monetary issue.

With lower unemployment and higher inflationary pressure one can expect that the Federal Reserve will be more aggressive than the ECB and we can expect North American rates to rise more quickly and higher than the EU.

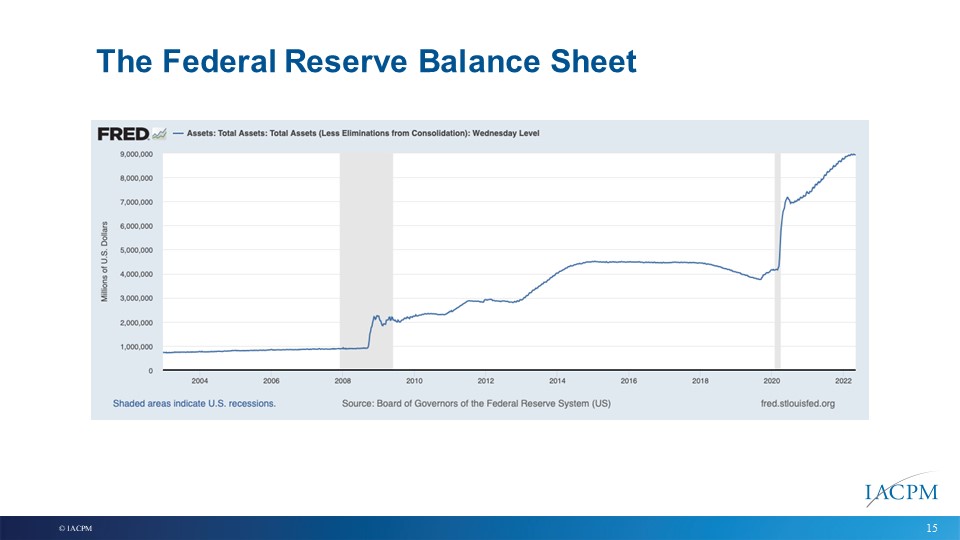

The Federal Reserve is only now beginning to unwind QE which will put further pressure on interest rates, reduce market liquidity and one must question whether it has the dry powder to respond if they overshoot and create a recession.

Actual commercial defaults have been very low in large part as a result of market liquidity, investors stretching for yield and direct support to business from government programs. We have taken the Kamakura Expected Cumulative Default data and have developed a series of forward 1-year expected default curves.

Actual commercial defaults have been very low in large part as a result of market liquidity, investors stretching for yield and direct support to business from government programs. We have taken the Kamakura Expected Cumulative Default data and have developed a series of forward 1-year expected default curves.

The Federal Reserve appears to have waited too long to both confirm employment levels as well as inflationary pressure. It appears to have underestimated demand and overestimated supply in their models. This is the reason we stress test our models.

It was once said that the job of the Federal Reserve is to remove the punchbowl when the party gets started – it looks like this time they are removing the punchbowl after we all have hangovers.

Today’s biggest challenges all add pressure to interest rates, prices and supply chain disruptions. Upward pressure on North American interest rates, upward pressure on energy prices combined with China’s zero covid policy will result in ongoing supply chain disruptions, increased shipping costs and parts and product shortages. Sovereign debt especially for emerging market countries could be at significant risk from rising interest rates, a strong dollar and global economic slowing.

Reminder that the role of the risk manager is not to predict the future but to model possible outcomes and lead the discussion about risk appetite of their firm in light of their model simulations.

It was very surprising how few of the attendees were even in their current position during the Great Recession.

You must understand how your model works before you can determine whether it is appropriate for its purpose.

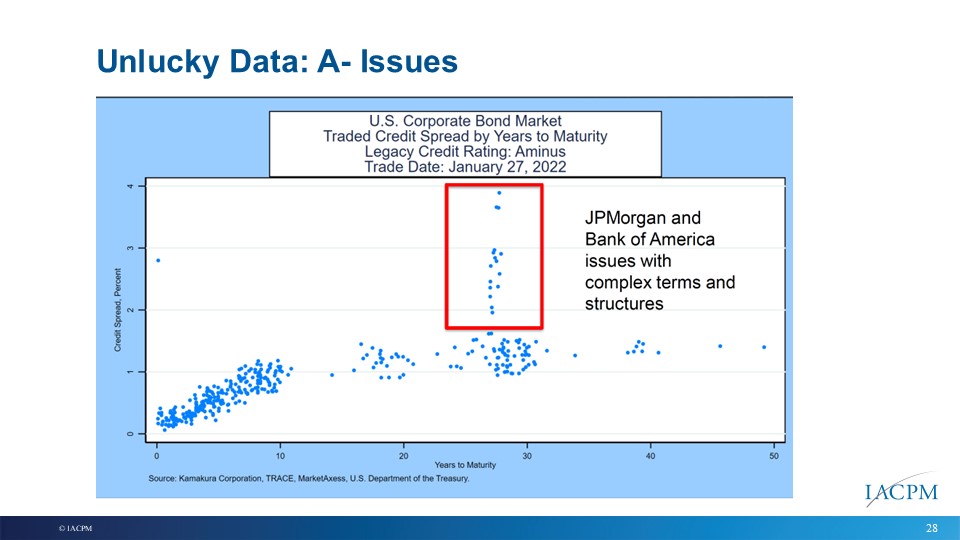

Data detail matters. This is often overlooked by the modeler and the practitioner

Steve Koonin, who was Undersecretary of Science under President Obama has written an excellent book highlighting the uncertainty of current climate models and moreover, the lessons and observations are relevant for all modeling.

These final thoughts are risks that we may face in the near term – the key question is whether your model can capture these and others